China is a ‘kung fu master’ and can deliver ‘deadly punch’ to US economy in trade war, ex-official says

China has many options for retaliating against the US and is likely to implement tariffs that go beyond trade in goods, a former top government official says

Wei Jianguo, a former vice-minister in the Ministry of Commerce, says China has the ‘willingness to act to fight a prolonged war’

Orange Wang

Published: 11:52am, 13 May, 2019

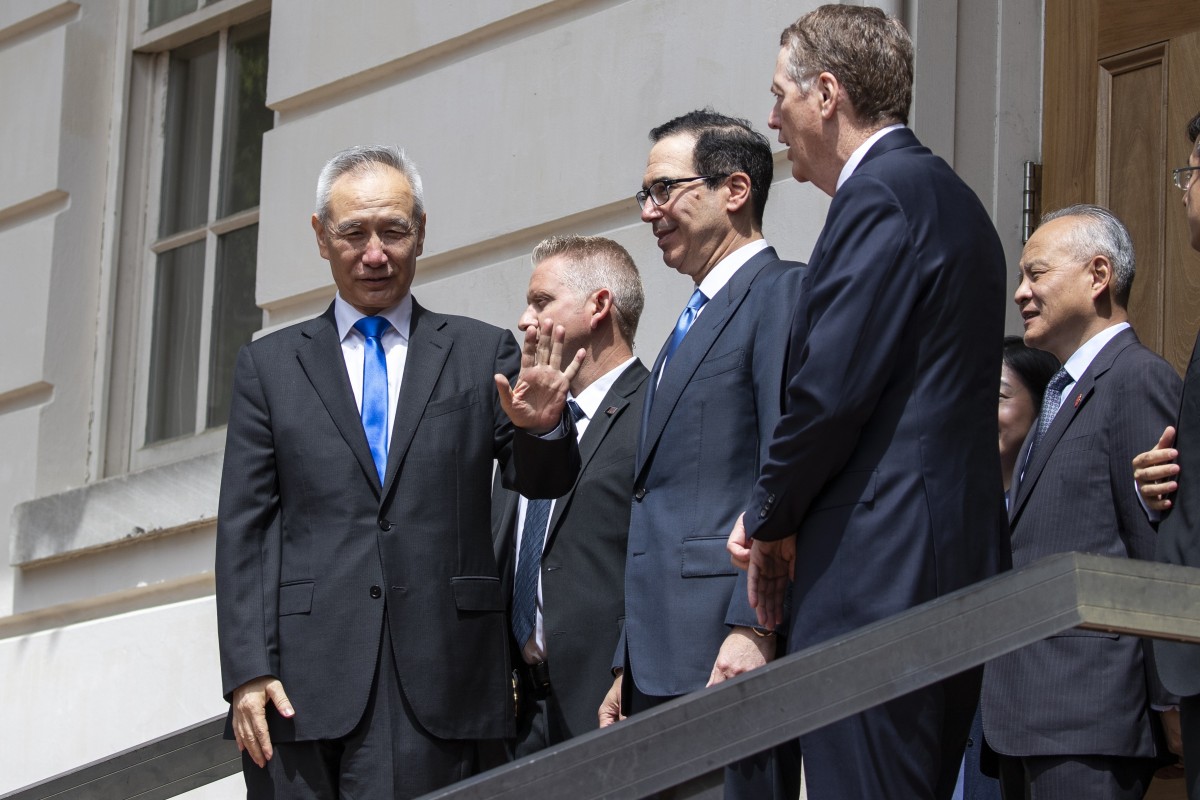

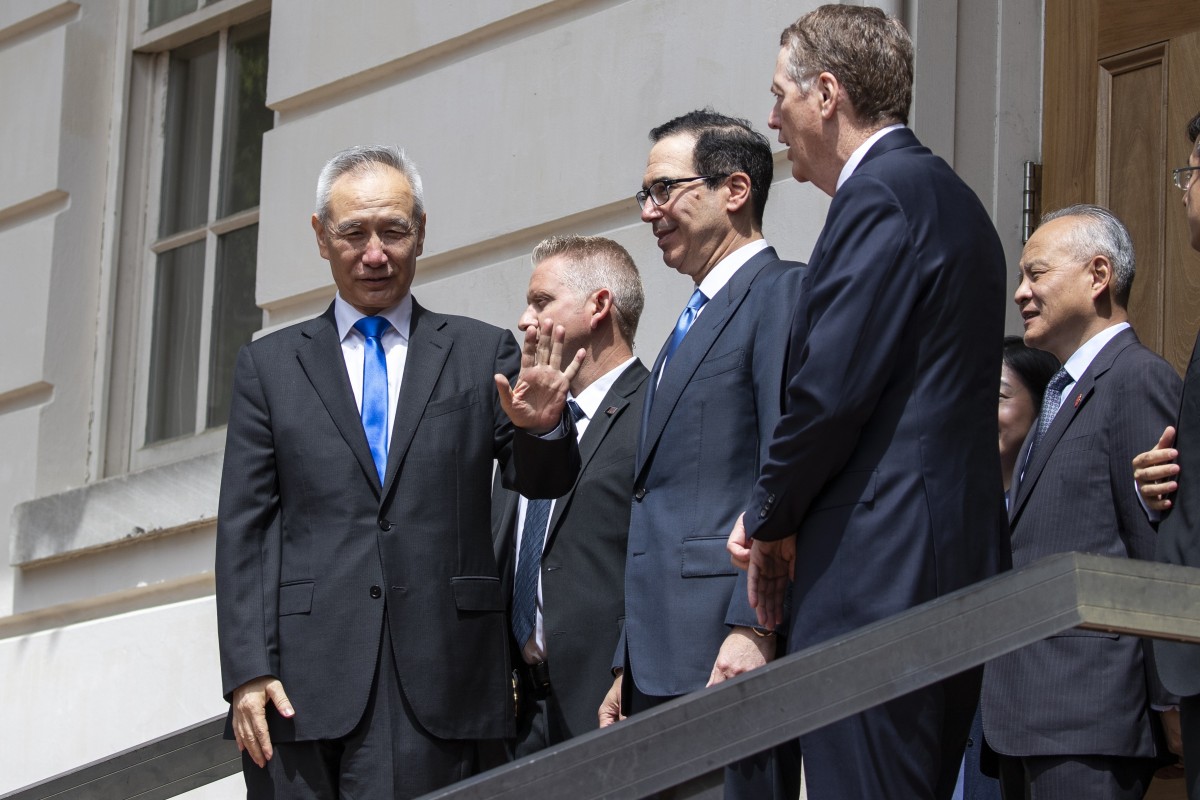

Liu He, China's vice-premier, departing negotiations in Washington on Friday after a meeting with US Trade Representative Robert Lighthizer (foreground right) and US Treasury Secretary Steven Mnuchin. Photo: Bloomberg

China has many options for retaliating against the United States and is likely to implement sanctions that go beyond tariffs on trade in goods, a former top government official said.

Wei Jianguo, a former vice-minister at the Ministry of Commerce (Mofcom) responsible for foreign trade, said China still had abundant tools in its armoury and has already prepared a contingency plan to deal with the escalation of the trade war.

“China will not only act as a kung fu master in response to US tricks, but also as an experienced boxer and can deliver a deadly punch at the end,” Wei told the South China Morning Post, adding that the world’s second largest economy is prepared for an extended trade war with the US.

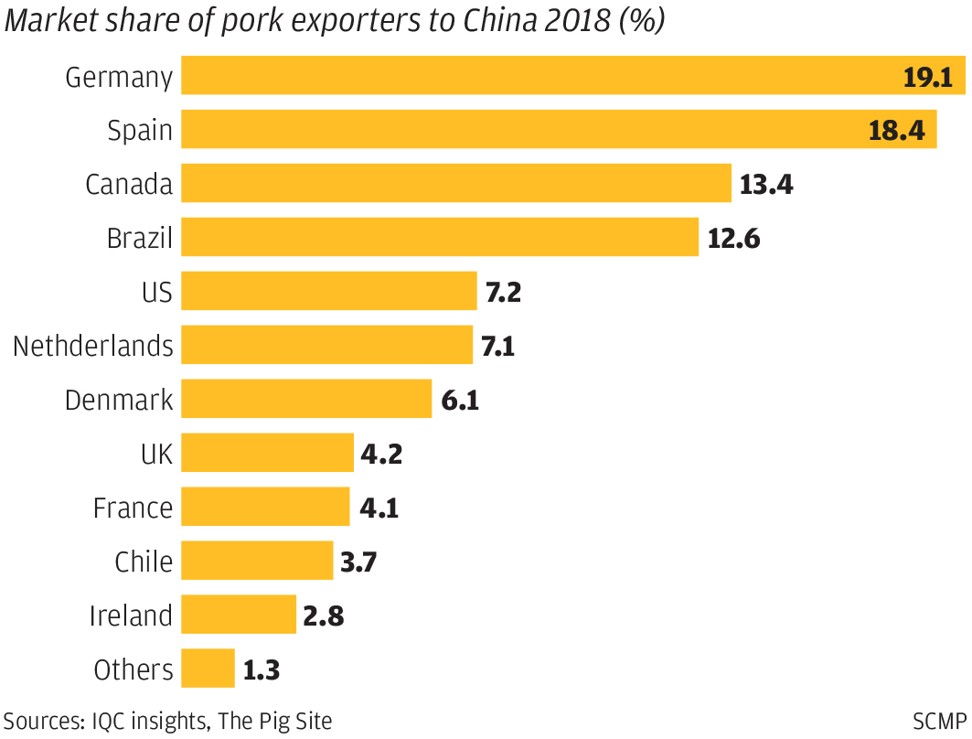

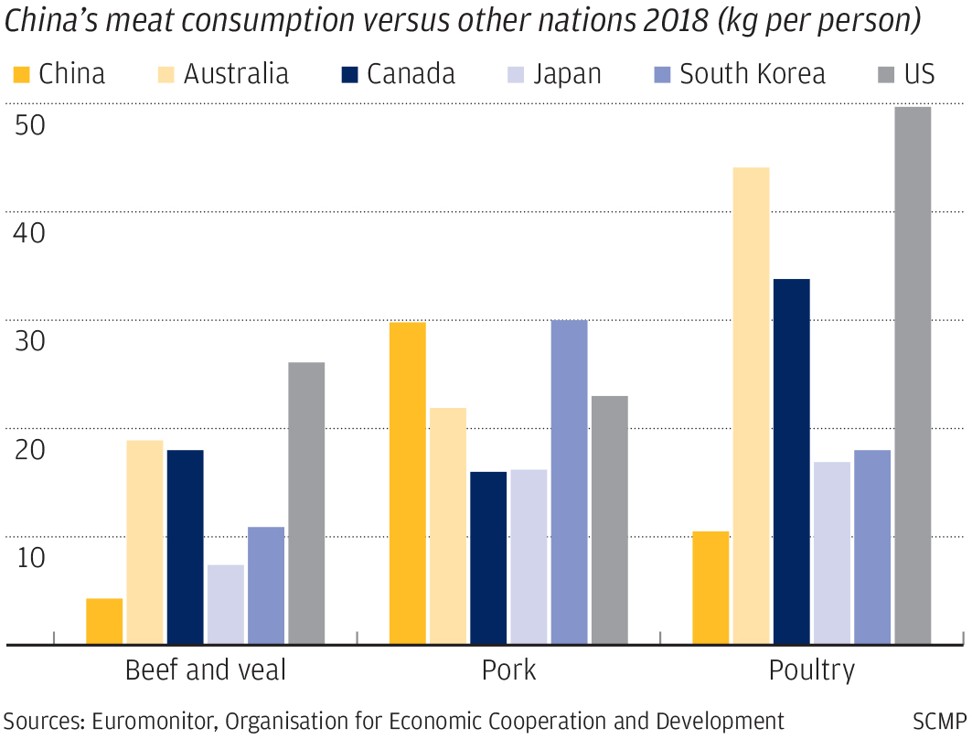

US agriculture products would be a natural primary target for retaliation, especially wheat, corn and pork, Wei said. These would directly target a key part of US President Donald Trump's electoral base in the run-up to the 2020 election.

“China has not only the determination and capability, but also willingness to fight a prolonged war,” Wei said. “The decision makers already fully understand the pattern of the US in the trade talks.”

China could also place sanctions on US planes and vehicles, he said, making it more difficult for these products to enter the Chinese market.

The jewel in the crown of the US aviation market, Boeing, was expected to be a beneficiary of a US-China trade deal. It was reported that China was preparing to buy 100 Boeing planes worth more than US$10 billion, in a bid to satisfy US desires to narrow the trade deficit.

China could move beyond the goods trade and target services, particularly in the finance, tourism and cultural sectors, Wei said. It had been expected that a trade deal would nudge China towards liberalising some of its services markets, particularly financial sector industries.

Wei warned that Washington made a strategic mistake in raising tariffs on US$200 billion worth of Chinese goods from 10 per cent to 25 per cent last Friday. The move might backfire because “extreme pressure” would not force China to capitulate.

Wei Jianguo, vice-minister of commerce from 2003 to 2008, before which he was vice-minister in the Ministry of Foreign Trade and Economic Cooperation, a predecessor of Mofcom. Photo: Handout

“If [the US] does not realise its mistake, it will create problems of a historic nature,” he said.

Wei was a vice-minister at Mofcom from 2003 to 2008, before which he was vice-minister in the Ministry of Foreign Trade and Economic Cooperation, a predecessor of Mofcom. In the current Mofcom administration, there are four vice-ministers, each with a different portfolio. He is now vice-chairman of the China Centre for International Economic Exchanges, a think tank linked to the Chinese government.

Analysts have also warned that a national security review process for foreign investments in China might enable Beijing to freeze out US investment to an even greater extent than before, as another form of retaliation.

In China, “economic security” has become a top item on the government agenda, following a notice posted in April by the state planner, the National Development and Reform Commission, stating that its public service department would start accepting applications for national security reviews of foreign investment deals because of an “adjustment of departmental responsibility”.

The National Development and Reform Commission (NDRC) headquarters in Beijing. The NDRC has made “economic security” its top policy agenda. Photo: Simon Song

China’s national security review process for foreign investments may have become more opaque as the country steps up its efforts to protect its economic security, a top agenda item for the current government.

While the US has used “national security” as the justification for rolling out Section 232 tariffs on products such as steel and aluminium, and is considering using the same rationale for levying duty on the global car industry, it is not thought to have the same leverage to act in this manner as Beijing’s central planners.

Over the weekend, Trump and his team of advisers took to social media and television to defend the tariff increase, which went into effect on Friday.

“We have to change the trading relationship between two countries for the benefit of the US and its workforce and its ranchers and farmers and so forth. We have to do this,” White House economic adviser Larry Kudlow said in an interview on Fox News Sunday. “The relationship has been too unbalanced.”

Kudlow broke with Trump’s long-term line that Chinese exporters pay tariffs, a claim that has long since been debunked: tariffs are paid by importers to release products from the dock when they enter a country.

“In fact, both sides will pay. Both sides will pay in these things,” Kudlow admitted.

Trump himself took to Twitter on multiple occasions, saying that China “broke the deal” and that the US will be “taking in tens of billions of dollars in tariffs from China”, adding that “buyers of product can make it themselves in the USA (ideal) or buy it from non-tariffed countries”.

US Trade Representative Robert Lighthizer is thought to be ready to impose tariffs on the remainder of China’s exports. Photo: Reuters

On Friday, the Office of the United States Trade Representative (USTR) issued a notice confirming the tariff increase to 25 per cent, but also saying that the president “also ordered us to begin the process of raising tariffs on essentially all remaining imports from China, which are valued at around US$300 billion”.

“The process for public notice and comment will be published soon in the Federal Register. The details will be on the USTR website on Monday as we begin the process before a final decision on these tariffs,” read the note.

Reply With Quote

Reply With Quote